Nick Lamparelli, Co-Founder and CEO of The Insurance Advocacy Forum of Florida, Managing Partner at Insurance Nerds, and well-known Insurance Industry Advisor and Thought Leader hosted openIDL‘s Executive Director, Josh Hershman and Ecosystem Manager, Lanaya Nelson to discuss the current state of the Linux Foundation-hosted network at a high level. Together, the webcast participants explore the challenges and breadth of opportunity the network holds for the industry.

The importance of data within the insurance industry cannot be overstated. It IS the business. From risk assessment to pricing strategies, data serves as the backbone of decision-making processes. However, the industry has long grappled with challenges in data exchange and standardization, hindering efficiency, innovation, and profits.

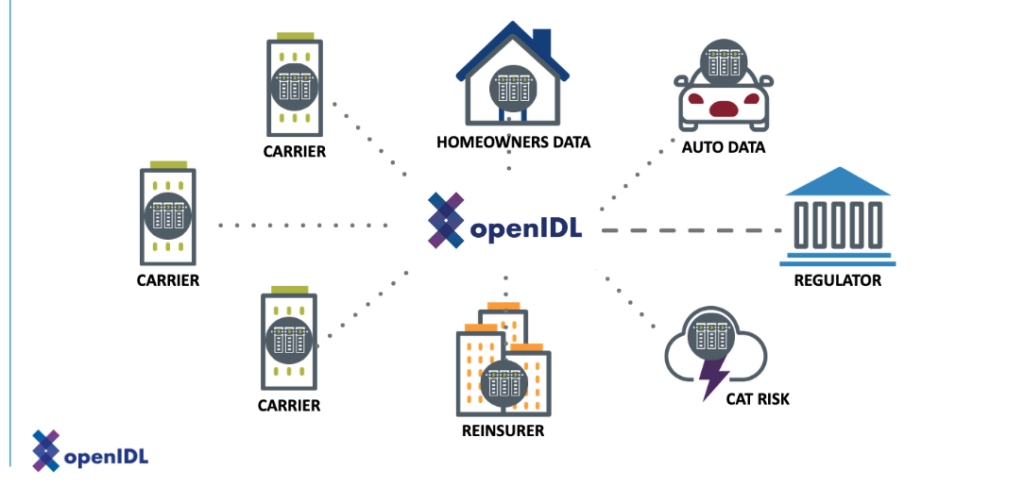

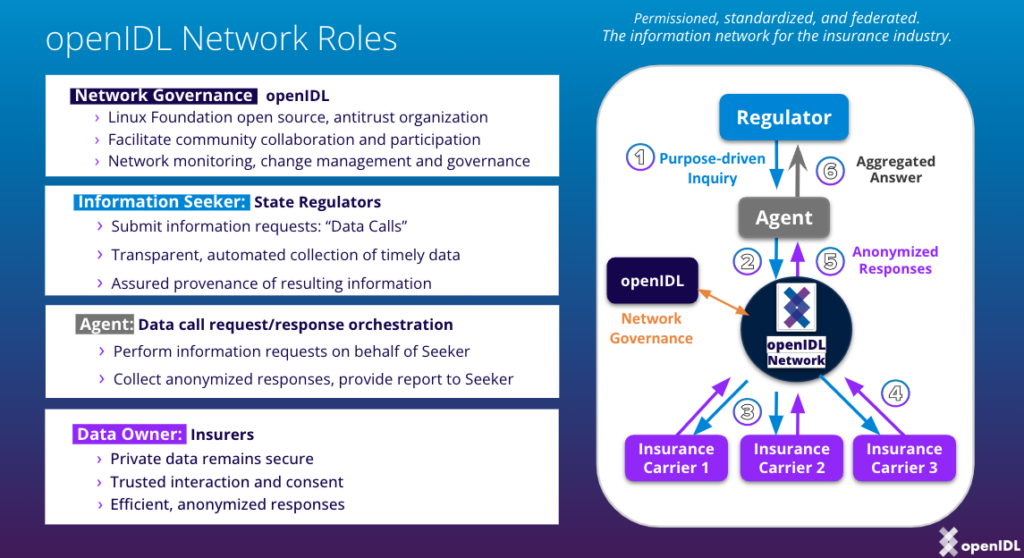

Open Insurance Data Link (openIDL), a Linux Foundation-hosted project and consortium, is poised to revolutionize how data flows within the insurance ecosystem. The openIDL community aims to build an open, secure, and permissioned data exchange network. To precede, openIDL must facilitate the establishment of stakeholder-agreed upon data standards. Once standards are set, the benefits of secure and efficient data exchange over the network are predicted to surface and bring tremendous change and opportunity to the industry.

At the heart of openIDL lies the simple yet powerful concept: improving data exchange between parties within the insurance industry. Although the network and its community are focused on the initial exchange use case between carriers and regulators, the success of this exchange will build the strong foundation for data exchange between any permissioned parties seeking a more secure, accurate, efficient, and robust mechanism that unquestionably trumps the common method used today: emailing spreadsheets.

Then, What is Standing in the Way? Stuck Standing at Standardization.

Another industry example of easier said than done. The big elephant in the room and primary requirement for the successful leap to better industry data exchange is the establishment of agreed-upon data data standards and models between stakeholders (i.e. competitors and regulators). Operating in such a highly regulated and competitive landscape, one in which risk aversion is the name of the game, it is no wonder expediency takes the back-burner to the delicate path to congruity between parties.

There are long-standing and understandable challenges in determining which data elements are necessary for regulators and convincing carriers of their importance, at times their necessity. Historically, determining the adequate data elements for regulators has been a point of contention and often leads to lengthy back-and-forth discussions and negotiations. Maintaining and balancing a marketplace is no small feat, but at what point does the pain of safely remaining in legacy become detrimental to the overall marketplace and its consumers? At what point does resisting cooperation and participation in the next industry era start to effect business bottom lines?

“I believe that having a better data exchange between carrier and regulator will make those markets stronger and will make them more efficient for the underlying carriers.” – Nick Lamparelli

openIDL addresses this stalemate challenge by providing a framework that minimizes debate and maximizes efficiency, allowing carriers to have agency in the next wave of regulation and the requirements that are tethered.

“What openIDL would be there for is creating the network and creating the standards for the exchange to take place… once we have the standard set up, there really shouldn’t be much adjudication involved as to whether or not this data should or shouldn’t be collected or distributed to the regulator [after the agreed-upon standards are established]. ” -Josh Hershman

With predefined standards in place, the focus shifts from debating data relevance to leveraging it for strategic advantage – benefitting all parties.

How to Tap Into the Power of Better Data Exchange

The leading fundamental use case for data exchange over the openIDL network between carriers and regulators will not only benefit regulators in gaining insights into market dynamics but will also empower carriers with clearer guidelines on data requirements. The result of building the network successfully will be in strengthening the overall market and enhancing efficiency and producing better data quality for both parties. Building successfully, though, is and has been a challenge. So, how can this be built successfully?

“…the only way we get there is having the network in place that underpins all of the flow of this data. That’s why I’m so excited about openIDL and the Linux Foundation in general.” -Josh Hershman

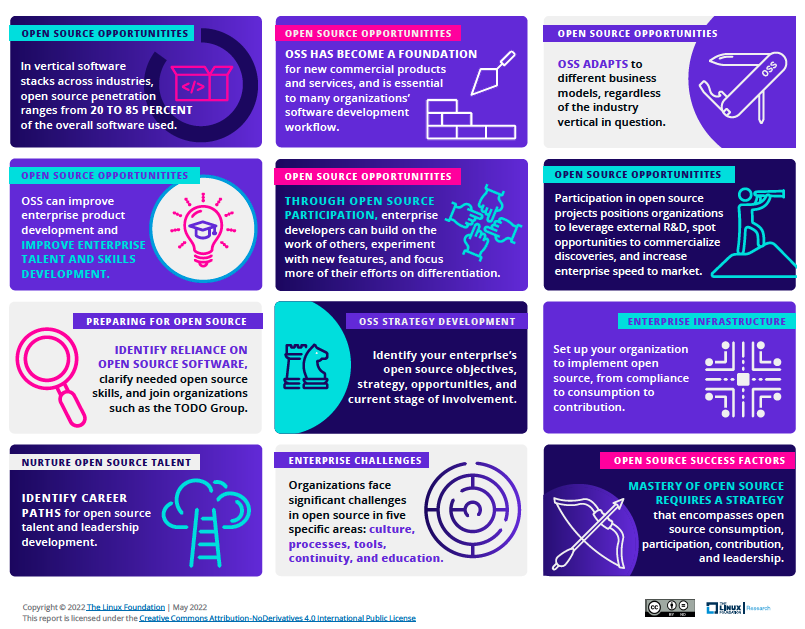

Step 1: Cultivate and engage the participation of a Robust Industry Stakeholder Consortium on a Truly Non-Proprietary and Trusted Platform enforcing the Proven Open Governance Model, the bedrock of great industry opportunity to follow.

Strep 2: Establishing agreed-upon Data Standards

Step 3: Developing on a strong, trusted, and dynamic open source technology platform to create a secure, permissioned data exchange network between parties.

The path:

- Start with carriers-to-regulators

- Next, move to broader application of Data Standards: while the initial focus is on data exchange between carriers and regulators, there’s recognition that data standardization can benefit various transactions within the industry. This includes interactions with reinsurers, MGAs (Managing General Agents), and other stakeholders (cross-industry).

- Cross-Industry Standardization: participants acknowledge the potential for data standards to extend beyond the insurance industry, with examples cited from the automotive sector. Standardization across industries could lead to more efficient processes and better risk assessment.

Step 4: Additional Transformative Impacts: Pricing and Risk Assessment, New Use Cases for the Network and New Product Development

One of the most significant benefits of data standardization is its potential to revolutionize pricing and risk assessment. By harnessing near-to-real-time data from diverse sources, insurers can tailor products to individual needs with greater accuracy. Imagine a future where auto insurance premiums adjust dynamically based on driving behavior or homeowners insurance reflects real-time property usage—such possibilities are within reach. Also to mention new product development, more personalized features, and improved customer engagement and retention.

Beyond Regulators: A Holistic Approach

While the initial focus is on regulatory compliance, the implications of data standardization extend far beyond. From interactions with reinsurers to managing general agents (MGAs), standardized data protocols promise to enhance various facets of the insurance value chain. Moreover, the potential for cross-industry standardization opens doors to unprecedented collaboration and innovation.

“Nick, your point is spot on in the sense that if you have everything in some sort of distributed ledger and it just continues to live, it should ultimately make for a better, healthier marketplace. If you’re pulling in more data and you are engaged in the community and the network, at the end of the day you will also be more engaged with your customer. -Josh Hershman

Embracing the Future of Insurance

As we embrace the era of data-driven decision-making, initiatives like openIDL pave the way for a brighter future in insurance. By fostering a culture of collaboration and innovation, standardized data protocols empower stakeholders to navigate the complexities of an ever-evolving landscape. With every exchange of data, we inch closer to a more resilient, inclusive, and strong overall marketplace and a profitable, customer-centric insurance ecosystem.