Property and casualty insurance runs on data. Yet without shared standards, every integration becomes a one-off, every mapping introduces risk, and every new requirement slows innovation. In a recent webinar hosted by Cloverleaf Analytics, leaders from AAIS, Cloverleaf Analytics, and Perr&Knight explored how openIDS (Open Insurance Data Standards) can change that by delivering an open, extensible, and technology-agnostic approach to data exchange across the P&C insurance ecosystem.

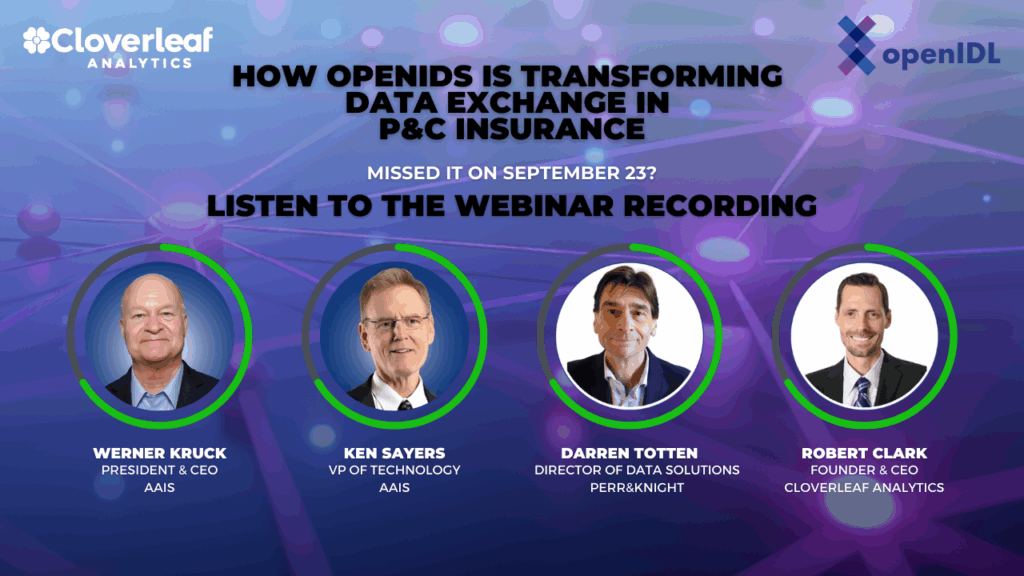

The webinar “How openIDS is transforming data exchange in P&C Insurance” featured moderator: Werner Kruck, President & CEO, AAIS and panelists: Ken Sayers, VP of Technology, AAIS; Darren Totten, Director of Data Solutions, Perr&Knight; and Robert Clark, Founder & CEO, Cloverleaf Analytics. Here’s what they discussed.

What is openIDS?

OpenIDS is a community-driven standard under openIDL at the Linux Foundation that defines what data the industry needs to exchange and how to represent it consistently. It does not lock anyone into a specific vendor or transmission protocol. Teams can move data in JSON, CSV, XML, or other formats while staying aligned on the schema, codes, and definitions.

“It’s open and free forever… managed and owned by the Linux Foundation. None of us owns the standard.” – Ken Sayers, AAIS

Why it matters

Panelists aligned on three pain points openIDS is designed to solve:

- Integration friction: Integrations and historical data conversions are often the “longest poles in the tent.” A shared model shortens timelines and reduces project risk.

- Quality and trust: Repeated remapping is like making a photocopy of a photocopy. A standard preserves fidelity and improves downstream analytics.

- Speed to value: Implement the standard once, then reuse for carriers, MGAs, reinsurers, bureaus, vendors, and regulators.

The bottom line is the less time we spend untangling formats, means more time we can spend on underwriting, pricing, analyzing risk, serving customers, and complying with data calls.

How openIDS was developed

- Proven foundation: Cloverleaf contributed a mature, production-tested core model plus extensions across 47+ lines of business.

- Pragmatic design: The model flattens policy, coverage, risk, and claim details where appropriate to make data transfer and integrity simpler than highly normalized operational schemas.

- Extensible by design: The standard supports line-of-business and organization-specific extensions without breaking compatibility, so the community can evolve quickly as new data emerges (think EV attributes, IoT signals, new perils).

Where things stand

- Homeowners v1.0: The first openIDS line is out for comment and targeted for release as version 1.0.

- Parallel workstreams: Additional lines of business are being queued based on community demand and impact.

- Near-term demonstrations: Expect proofs of concept showing end-to-end reporting and dashboards built on the standard to follow early releases.

“As policy admin and claims vendors, regulatory bodies, and service providers adopt openIDS, ‘integration’ stops being a dreaded project and becomes plug-and-play.” – Robert Clark, Cloverleaf Analytics

Practical use cases

For insurers and managing general agents (MGAs)

- Faster statistical reporting and data calls

- Cleaner pipelines for pricing, reserving, and portfolio analytics

- Easier data sharing with fronting partners and reinsurers

For reinsurers and brokers

- Standardized bordereaux and exposure submissions

- Reduced bespoke mappings across counterparties

For vendors and service providers

- Reusable connectors and accelerators

- Less time on Extract, Transform, Load (ETL), more time on analytics, product, and user experience (UX)

For regulators

- Consistent, higher-fidelity data with lower burden on filers

- Ability to ask timely questions without imposing costly custom formats

“Integrations always succeed when both sides agree on a common standard. The hardest work isn’t technology, it’s alignment.” – Darren Totten, Perr Knight

How openIDS compares to proprietary formats

- Open and free: No license fees, no vendor lock-in.

- Tech-agnostic: Use JSON, CSV, XML, or other transports that fit your stack.

- Evolves with the market: Extensions let you add new attributes immediately while the community standardizes them over time.

AI makes standards more valuable

As organizations adopt AI for analytics, fraud detection, and automation, data quality is everything. Standardized, well-defined, and consistent inputs make AI outputs more reliable and explainable. Panelists also noted emerging opportunities to apply AI to accelerate mapping from legacy systems into the openIDS schema.

Key takeaways

- Reduce cost and complexity: Shrink timelines for integrations, conversions, and reporting.

- Improve accuracy: Preserve data fidelity and avoid drift from repeated remaps.

- Move faster together: One shared language unlocks innovation across the value chain.

- Have a voice: Members help set priorities, choose next lines of business, and shape the roadmap.

Call to action

Ready to help modernize P&C data exchange? openIDS grows with participation. There are simple ways to start:

- Become a member of openIDL. Membership is open to carriers, MGAs, reinsurers, brokers, regulators, vendors, and partners. Fees scale by company size.

- Contribute to the standard. The openIDS Working Group and Homeowners Workstream meets on Mondays. Join an openIDS working group or workstream

- Share feedback on the Homeowners openIDS Residential Structure Model.

- Share assets: Review specs, contribute schemas and sample data, validate implementations, or pilot an integration.

- Promote adoption: Socialize the standard with partners and vendors to grow the network effect.

To watch the webinar on demand, click here, and request permission to view.

Together, we can replace one-off integrations with a durable, open standard that accelerates innovation and strengthens the entire insurance ecosystem.